TSMC Solidifies Leadership on Foundry Market as Intel Jumps into Top 10

2023-12-06

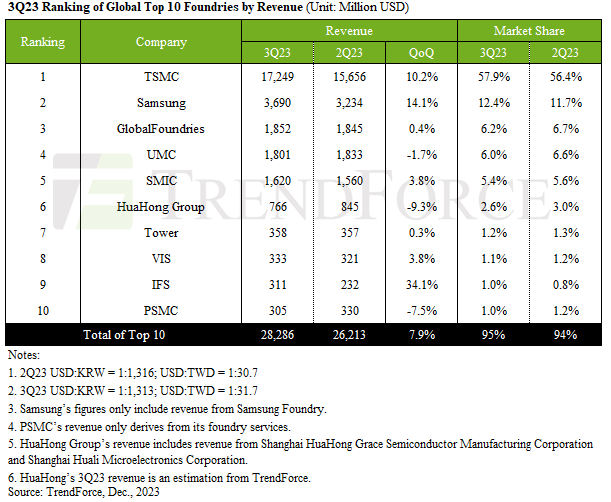

The global foundry industry witnessed a substantial rise in demand in the third quarter of 2023, according to TrendForce. The Top 10 foundries collectively saw their revenue soar to about $28.29 billion, marking a 7.9% increase compared to the previous quarter. Taiwan Semiconductor Manufacturing Co. (TSMC) maintained its No. 1 position as it managed to increase its shipments, whereas Intel Foundry Services found itself in Top 10 for the first time in the recent quarters.

TSMC, the world’s largest foundry, posted revenue of $17.249 billion for the third quarter of calendar 2023 and secured a 57.9% foundry revenue market share. TrendForce believes that TSMC’s growth was supported by robust demand across various sectors, including PCs and smartphones. One of the most notable drivers of TSMC’s revenue was the formal start of Apple’s 3nm chips shipments (or rather revenue recognition) in the third quarter. With Apple’s A17 Pro smartphone system-on-chip as well as M3, M3 Pro, and M3 Max PC SoCs shipping in high volume, 3nm fabrication technology accounted for 6% of TSMC’s total revenue for the quarter, whereas advanced nodes accounted for almost 60% of TSMC’s sales.

Samsung Foundry also had a fruitful quarter, experiencing a 14.1% growth in its revenue, which amounted to $3.69 billion, according to TrendForce. Samsung itself says that demand for its advanced process technologies is increasing (which is a likely scenario), but TrendForce seems to be a bit more cautious as it says that growth drivers for Samsung were diverse and included orders for Qualcomm’s mid-to-low range 5G application processors, 5G modems, and time-proven 28 nm OLED display driver ICs.

GlobalFoundries maintained a consistent performance, with its revenue hovering around $1.85 billion, similar to the previous quarter. A significant portion of its revenue came mainly from the Internet of Things (IoT) market, particularly in home and industrial sectors, and significant orders from the U.S. aerospace and defense sectors, according to TrendForce.

UMC experienced a mixed quarter. Despite a marginal quarterly revenue decrease of 1.7%, bringing it to around $1.8 billion, the company saw a notable uptick in its 28/22 nm product lines. This near 10% increase in revenue from these products offset the slight decline in overall wafer shipments.

SMIC, on the other hand, recorded a 3.8% increase in its revenue, which stood at $1.62 billion for Q3. However, the company faced a shift in its client base: revenue from Chinese clients surged to 84%, buoyed by the government’s push for localization and urgent orders for smartphone components. By contrast, revenue from American clients diminished due to supply chain diversification and the relocation of American customers outside China. What is a bit surprising is that although SMIC ramped up shipments of Huawei’s Kirin 9000S system-on-chip (SoC) in Q3, this did not affect its revenue significantly. Perhaps, because Chinese companies ordered mostly cheaper chips than their American counterparts, revenue from shipments of 7nm products was offset by shipments of large volumes of inexpensive silicon.

What is particularly noteworthy is that Intel Foundry Services got into the Top 10 foundries for the first time in several quarters. IFS earned $311 million in revenue in Q3 2023, up 34.1% quarter-over-quarter, which could be a result of the company’s working with Amazon Web Services, which ramped up production and assembly of its Graviton4 and Trainium2 system-in-packages that require advanced packaging technologies.

In general, global foundry industry is on an upward trajectory, led by TSMC, Samsung, SMIC, and IFS. Smaller and specialty foundries — such as Tower Semiconductor and Vanguard International — demonstrated mixed results. Tower’s revenues increased 0.3% QoQ, which is basically flat, whereas VIS posted a 3.3% quarter-over-quarter increase.

By contrast, HuaHong Group experienced a 9.3% quarter-over-quarter downturn, with its Q3 revenue falling to approximately $766 million. PowerChip Semiconductor Manufacturing Co. (PSMC) also saw its revenue decrease by 7.5% to $305 million, largely due to nearly 10% and 20% declines in the revenues from PMIC and power discrete products, respectively, which affected its overall performance, according to TrendForce.

TrendForce expects continued demand as the industry moves into the fourth quarter, especially when it comes smartphone components, which is a huge market that requires both leading-edge and fairly simplistic chips.

Source: TrendForce